If you’re in the market for a new electric car, then chances are you’ll need to investigate financing options. The process of researching your loan options and comparing lenders is typically lengthy, confusing and stressful.

Thankfully there’s a new service called Driva that’s here to help. Driva is an online platform that allows you to enter a few personal details and through the use of innovative machine learning displays your best personalised rates from over 30+ Aussie lenders.

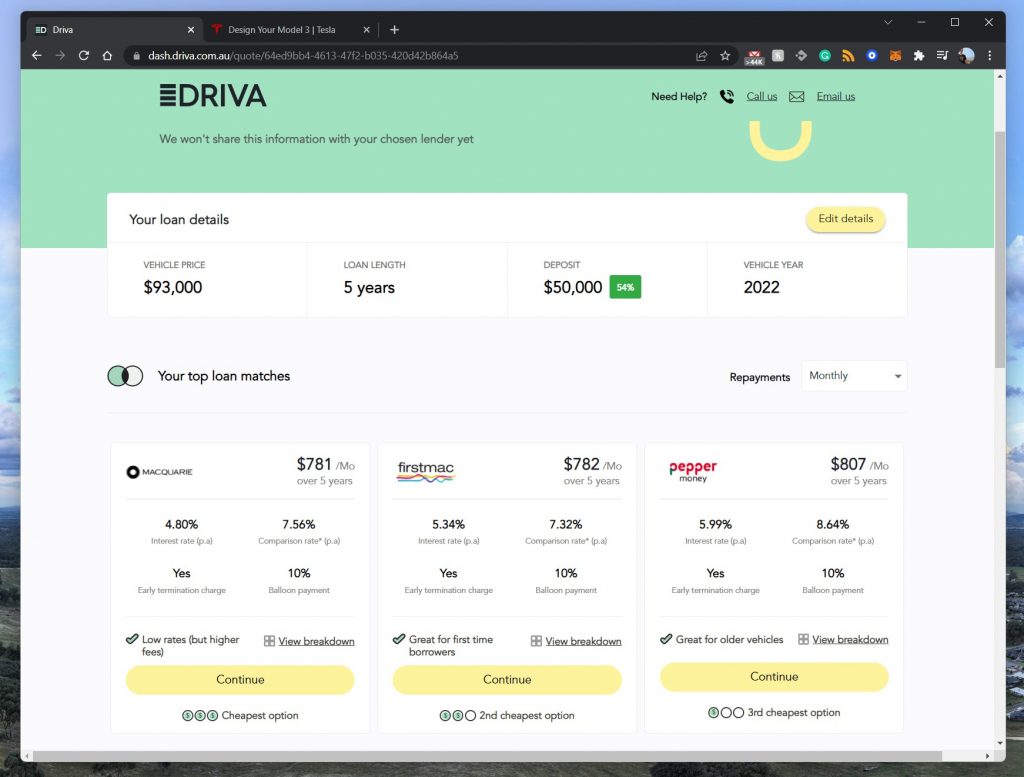

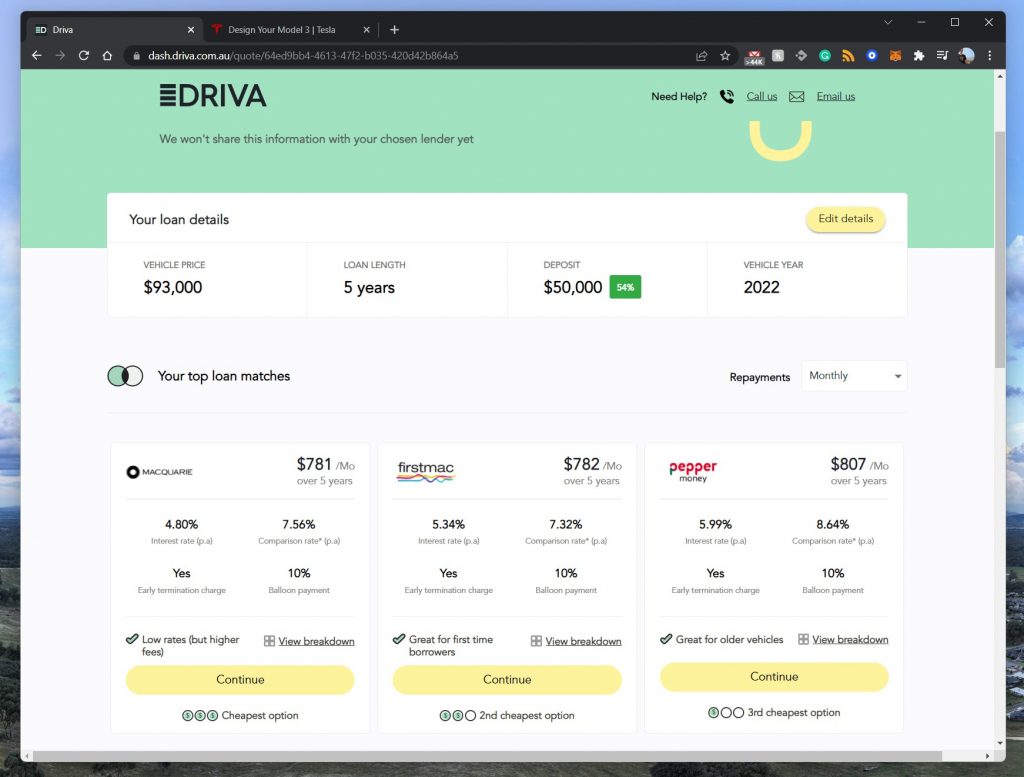

What Driva gets very right, is showing the actual interest rates and costs for each loan, on the screen, instantly. This means there’s no phone calls, no spreadsheets, just a modern experience built for modern buyers. The options presented to you are tailored for each customer and not simply generic rates, and are produced dynamically based on your personal information and vehicle preference.

Customers can complete the online form and see a list of pre-approved rates from lenders in just 60 seconds. Once you’re satisfied with your pre-approved offer, you can select it and start the loan application process. Once the application is approved by the lender, you can receive funds in your account in as little as 24 hours!

How does this benefit consumers?

Transparency – People visiting dealerships are usually pushed into taking the rate offered by the finance team without actually knowing if they are getting a good deal. Using Driva, you’re able to get a variety of personalised rates and compare this to what is being offered.

Save money – Everyone wants to save money where possible, especially on your finance commitments. With Driva you can compare rates from 30+ lenders and find the lowest interest rate possible. Over time this can lead to thousands of dollars saved in interest paid. Not to mention you can also refinance your existing car loan and get a better deal with the Driva platform.

Time – Physically contacting lenders, visiting multiple dealerships and performing online research can be a lengthy process and can even impact your credit score in some situations. With Driva, you only need to enter your personal details once and you get access to a list of pre-approved loans from multiple lenders for you to pick from. Quick and easy, they do all the heavy-lifting for you, so you can get behind the wheel of that new EV sooner.

What makes Driva unique?

Fully personalised – Pre-approved car loans and personalised rates in 60 seconds based on your unique financial situation. Unlike other platforms that just give you generic rates to start with and then surprise you with an increased interest rate further into the application.

No impact on your credit score – Driva doesn’t do hard checks on your credit file. Some customers don’t realise that each time you inquire for a loan at the dealership or with a bank, your credit score can take a hit in the process.

Commitment to customer satisfaction – With commitment to the customer experience at the forefront of all of Driva’s initiatives, the knowledgeable friendly team are on standby to help with the entire financing process, it’s smooth sailing. Not to mention they also currently have an impeccable 4.9 star rating on Trustpilot from 500+ reviews.

No hidden fees – Driva will tell you upfront exactly how much the loan is going to cost, and don’t play favourites with lenders. All lender fees and charges are already built into personalised quotes, which means the monthly repayment figure you see in the platform is exactly what will come out of your account each month and fully inclusive of all costs.

Driva takes the hard work out of the car loan application process from start to finish, ensuring that the entire process is 100% transparent and that there are no hidden surprises down the line. To find out more on how much you could save with an electric vehicle loan visit driva.com.au to get started.

Step by step process

- Visit driva.com.au and click get started

- Complete a short 60 second online assessment

- Received pre-approved that match your profile from over 30+ lenders

- Select the lender that best matches your preferences

- Complete your loan application via your driva dashboard

- Receive funds in as little as 24 hours