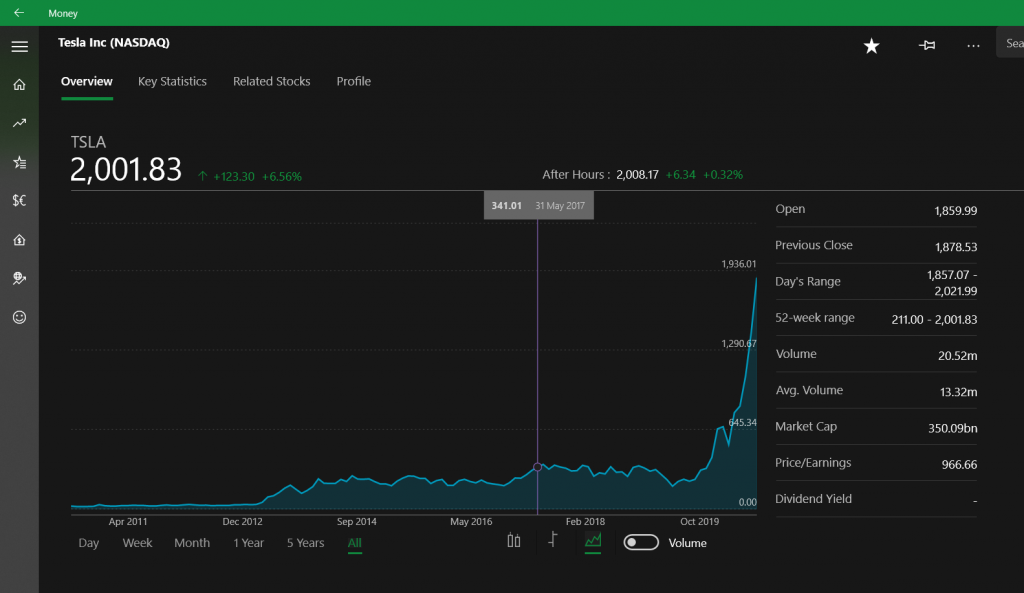

Tesla closed the day at $2,001.83, a new record high for the electric car and energy company. That represents a growth of 6.56% in the last 24 hours, but the most impressive metric is to take a second to look back at just a year ago.

Just 12 months ago, on 21/8/2019, Tesla shares closed at just $220.83.

The latest rise in value, which now stands at a massive $373.07 Billion, is a result of a number of factors.

The most immediate factor is an upcoming 5-1 stock split, recently announced by Tesla, which will begin on August 31st. The idea of splitting the stock, was to make the entry price more affordable to new investors. If the stock split happened today, the new $400 price is certainly achievable, but is likely more than Tesla expected, after the recent price rises.

Another key aspect is an expected inclusion in the S&P 500 on the back of 4 profitable quarters in a row. Inclusion in the index will require many funds to acquire a share of Tesla. With increased demand, the price will almost certainly increase, so investors are trying to get a slice of the company before that takes place.

The last and best reason for the price increase, is better recognition of Tesla’s market successes to date, combined with their opportunity to continue domination in the EV space.

Not only is the company rapidly expanding its production capabilities, with factories in Shanghai and Berlin, it’s also expanding in the US with the new Gigafactory Texas.

Tesla is often described as a technology company that happens to make cars. With their R&D efforts in everything from battery technology, to custom chip design, software, autonomous vehicles, recharging infrastructure, no other company has this breadth of product portfolio that perfectly positions them for success well into the future.

Tesla Energy is also another major factor. With a ramp up of their Solar Roof program, combined with more than 100,000 Powerwalls sold for residential and commercial energy storage, Tesla is also growing their footprint in utility-level storage. Not only are they making batteries, but as Tesla often do, they have a unique, technology-forward approach and are using Autobidder to win in energy supply markets.

The company continues to report strong demand for its upcoming products, with the RHD Model Y, Cybertruck, Tesla Semi and the next-gen Roadster, all on the to-do-list in the next couple of years.

The biggest risk to Tesla right now are external factors like Coronavirus, something they can’t control.