Today, Ampol released its 2023 Climate Report, an update on how they’re tracking towards zero emissions. Ampol is Australia’s largest transport energy distributor and retailer, with more than 1,900 Ampol-branded stations across the country.

In 2021, Ampol released its Future Energy and Decarbonisation Strategies which outlined Ampol’s pathway to reducing our operational emissions (Scope 1 and 2) to be net zero by 2040 in Australia. Interim targets for 2025 and 2030 were also set.

Ampol kicks off the report with a photo of a Hyundai Ioniq 5 electric vehicle, charging at one of their retail outlets with an AMPCharge installation. On page 2, we see an interior shot from a BYD Atto 3 and by page 4 we see a shot of an Ampol service station roof, blanketed with solar panels. You can see where this is going, Ampol is attempting to make one of the largest business pivots of the modern era, like legacy automakers, those companies that have been hooked on oil, need to transition their business to the new world of electric vehicles.

Ampol recognises the electrification of passenger and light commercial vehicles is underway and says they are investing. With support from Australian Renewable Energy Authority (ARENA) and the New South Wales government, they are rolling out a charging network of at least 500 EV charging bays by 2027. At many AMPCharge locations, we see 2 bays, with 1 charger, but these feature 2x charging connectors that can charge 2 cars at once, although speeds may be impacted.

Ampol says electric vehicle penetration will gradually increase from 2025 to become the

the predominant mode of transport by 2050.

Due to average vehicle ownership periods (10 years in Australia, 14 years in New Zealand), our scenario modelling shows that our customers’ demand for traditional transport fuels will remain robust well into the 2030s. In Australia, for example, we estimate that at least 80–85% of the passenger vehicle fleet will still be powered by traditional fuels well into the 2030s under all modelled scenarios, and cash flows from the core business should remain strong to support investment into the transition while maintaining shareholder returns.

I disagree. This feels incredibly slow and feels more like reassurance to existing investors and retail operators that the EV transition is further away than it actually is.

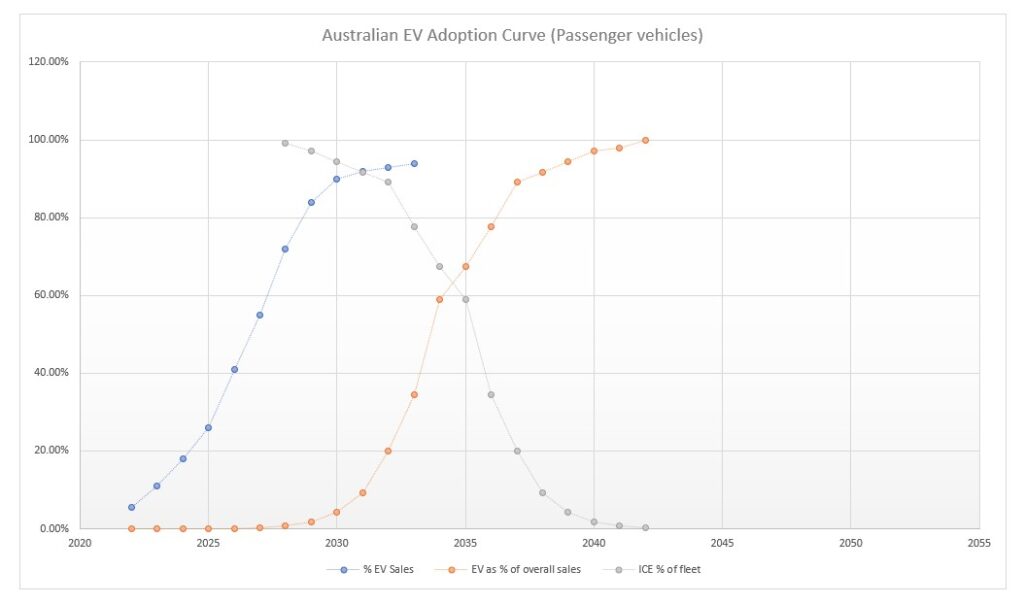

Australia’s EV adoption is likely to take a similar S-curve adoption that it has in other places in the world, and as does most other new technology.

There are a lot of assumptions that go into forecasting adoption curves and Australia’s EV adoption may go faster or slower depending on a lot of factors, chiefly among them Government policy, incentives, price, availability and charging infrastructure.

My prediction as it stands today is as follows.

EVs will be cheaper than ICE over the next few years (easily before the end of 2030), making a choice easy, assuming model availability is addressed in our largest categories like Utes.

By 2031/2032 we’ll see more EV sales than ICE (the first crossover point in the graphic below).

By 2035, we hit the second crossover point where there are more EVs on the road than ICE.

By 2042, the transition is effectively complete, with the vast majority of ICE off the road.

There are a lot of push/pull factors in this transition equation, such as the price of petrol rising as fewer ICE vehicles are on the road. The availability of petrol will reduce as service stations transition to EV charging locations.

On slide 10, under the ‘Targets by 2030 heading’, Ampol commits to a renewable energy target of 50% equivalent net renewable electricity for operational use in Australia. While this sounds good on the surface, when we look at the fine print, ‘Renewable electricity’ in this context refers to a combination of onsite solar, market-based (e.g. LGC’s, PPA’s etc) and grid decarbonisation.

Solar installations are an obvious and great initiative, but that last point is seriously questionable. This means they will rely on the grid greening to reach this target.

Ampol has locations around Australia, and states like Victoria are doing the hard work to reduce emissions and transitioning from coal-fired power to renewables at a rate of knots. The current VIC target is to reduce emissions 45-50% by 2030. This would leave Ampol able to do almost nothing to meet this target. They estimate it would then take another decade to achieve the other 50% reduction to hit zero emissions by 2040.

From the AEMO Dashboard, we can see the energy mix over the past 12 months featured 15% wind, 7% solar, and 9% hydro electricity, meaning 31% of Australia’s energy was produced by renewables over the last year. If we look at a state like South Australia, 56% of energy was delivered from wind, 7% by solar and 1% by battery a total of 64% renewable energy.

The job ahead of Ampol to transition this business is massive, with their total emissions 42,699,636 tCO2e.. also known as 42 Billion tonnes (t) of carbon dioxide (CO2) equivalent (e).

Ampol modelled a number of scenarios for this transition to renewable energy which chiefly deals with the transition from ICE to EVs. These figures are from the Ampol Integrated Assessment Model (2022).

Scenario 1 – Steady Progress

EV penetration in passenger vehicles (% stock)

- 2030 – 10%

- 2040 – 43%

- 2050 – 77%

Scenario 2 – 2˚C

EV penetration in passenger vehicles (% stock)

- 2030 – 15%

- 2040 – 55%

- 2050 – 95%

Scenario 3 – 1.5˚C

EV penetration in passenger vehicles (% stock)

- 2030 – 21%

- 2040 – 67%

- 2050 – > 95%

The transportation sector currently accounts for 19% of Australia’s emissions and personally, I don’t believe any of these are aggressive enough.

The report goes on to detail that Ampol’s climate scenarios indicate that EV fleet penetration in Australia is estimated to be between 10% to 20% by 2030.. Given it accounted for 8.8% of new vehicle sales in June 2023, I’m willing to bet they’re wrong.

Ampol is expecting price parity between EVs and Internal Combustion Engines (ICE) vehicles to arrive around 2030, but when we consider the total cost of ownership, that is already the case in some scenarios, and in the coming years is likely in most scenarios.

Ampol has commenced the installation of solar at retail outlets in conjunction with their

AmpCharge EV charging rollout. The business is installing ~5MW of solar panels (~50kW capacity per

site) with the solar energy generated at our Retail sites supporting electricity requirements of stores and EV charging. The renewable energy generated via these solar panels will be supplemented with electricity from the grid.

In the report, Ampol details their progress to date with the AMPCharge network. So far they have rolled out 22 AmpCharge bays in Australia to the end of May 2023, across 10 sites, and 4 states. These offer 150kW DC fast charging and customers have consumed ~291,000 kWh of energy. The average charging session was 30 minutes and typically customers took 27kWh of charge each time.

Let us know in the comments what you think and if you have any forecasts of when the ICE > EV crossover points are, I’d be keen to see them.