Earlier this week Commonwealth Bank today released Investorville, an online investment property simulator. Budding property investors can get familiar with the different aspects of the complex world of property investment, without putting any of their own capital at risk.

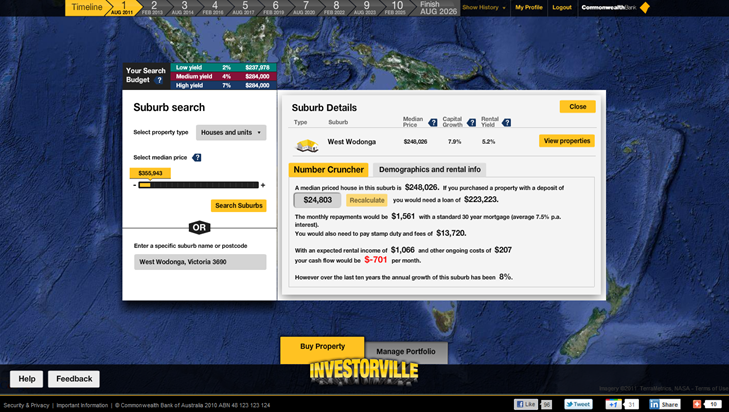

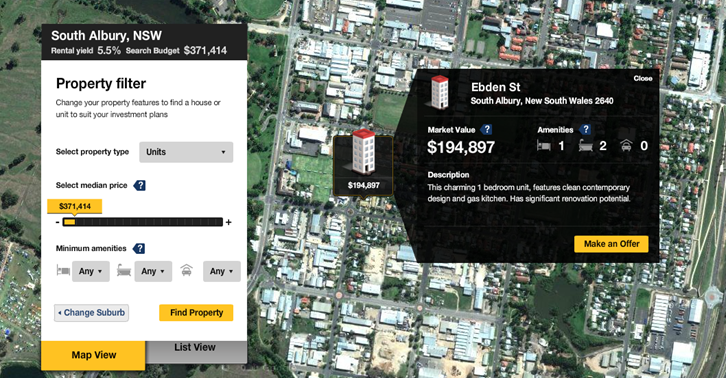

Developed in flash by creative agency BMF, the tool combines actual property data with a simplified set of variables. This means things like capital gains tax and land tax are simplified. It’s designed to give you an understanding of what it takes to be a property investor, but doesn’t bash you over the head with complexity.

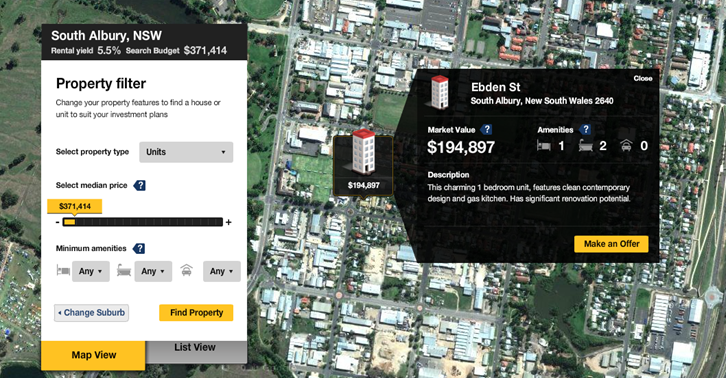

Start by signing up at https://www.investorville.com.au (a .tv email address isn’t supported), then choose a profile according to your situation, single, couple, family etc. Then just start searching for properties. Obviously the most applicable would be properties in your area, but you may find better deals further abroad.

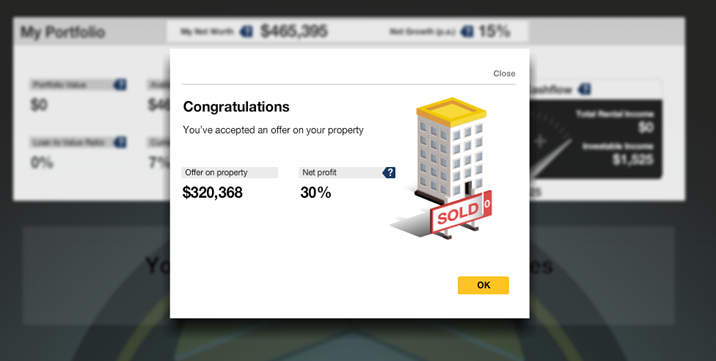

After buying your first property (hopefully cash flow positive), you then need to set rent prices. Fast forward a few months and you’ll find the simulator predicts you have received a wage rise, and your balance is plus income, minus expensive. From this point you may wish to sell the property, for a quick flip, but more likely a rental increase to stay consistent with current market values.

There’s also additional information on renovating, repairing, or even refinancing on your mortgage. After enough time has passed (thankfully not real-time) you’ll be able to buy additional properties and setup lines of credit. To have the properties overlayed on Google Maps give Investorville a ‘real’ feeling, or allows you to relate better to a real situation. It’s a great idea.

Commonwealth Bank says Investorville is aimed at existing home owners who may not realise their potential to invest in real estate, as well as those who already own an investment property. The end game here for CommBank is to give potential investors the confidence to take out a real-life loan, of which they net the interest.

“The really beneficial part of Investorville is that users can, in the true sense of the term, try before they buy. The properties and data are reflective of the Australian property market and the types of properties available” says Mark Murray, General Manager Commonwealth Bank Consumer Marketing.

The data used for the future values is based on the past, or the best data we have. Naturally rate rises, house prices and other variants will be different in reality to what’s simulated in Investorville. It’d be great to see it updated overtime, maybe monthly with the latest modelling to keep figures as realistic as possible.

For more information on Investorville or try it out yourself, check out www.investorville.com.au