Stake is an online stock trading platform that provides access to over 6,000 US stocks and ETFs for investors in Australia, New Zealand, and the UK. The platform is known for its user-friendly interface, low brokerage fees, and a variety of educational resources.

Stake has just added a new feature, the ability to trade outside the regular market operating hours, for a total of 16 hours per day.

Pre-market trading was once only available to institutional investors but is increasingly being offered to retail investors via platforms like Stake.

The big advantage of being able to trade before the market officially opens is that you can potentially secure better prices for trades, particularly when big moves are on. The majority of new features on Stake tend to land in the premium feature set under ‘Stake Black’, however, this offering appears to be available for all Stake customers.

On the east coast of Australia, the average trading session for the U.S. stock exchanges usually means you’d need to be up between 11:30pm – 6:00am to trade. With extended hours trading, you’d have time after work and before bed, to tackle the pre-market and if you wake in the morning and see more opportunities, then you’d have time in after-hours trading before work. This means there’s no need to stay up late or wake up extra early to participate in real-time investing.

Extended Hours trading is a chance to capture gains and prevent losses without waiting for the next regular session. You also get more time to interact with the market at more convenient parts of your day. Stake does warn customers that the dynamics of Extended Hours trading, particularly the lower volumes and liquidity, involve additional risks you should be mindful of.

Risks

Since investors tend to be less active during Extended Hours, this leads to lower trading volumes, less liquidity and wider spreads between bid and ask prices for stocks. Trades are executed by Electronic Communications Networks (ECNs), and large institutional investors and the usual market makers aren’t there.

Due to this lower level of activity, volatility levels can be higher than during the day. Reactions to earnings news or particular events can cause significant changes to share prices during these periods. Investors can face situations where the differences between buying and selling prices for shares are greater than during regular trading hours.

How to trade Pre-market of after-hours on Stake

- Sign up in minutes

- Activate your Stake Wall St account

- Fund your account and find the company you want to trade

- Place an order and toggle on Extended Hours if applicable

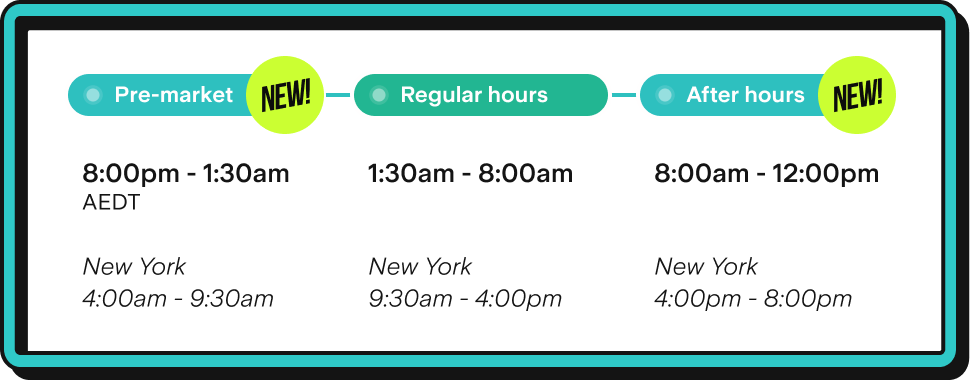

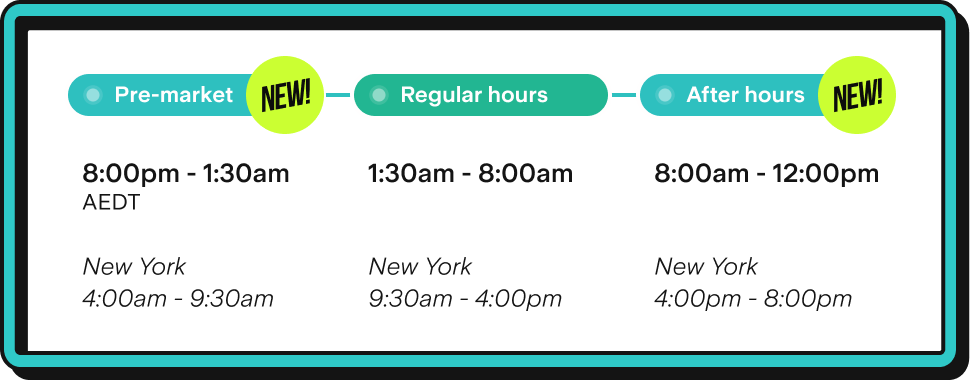

Pre-market is the 5.5 hours before the regular trading session in New York, and after hours means the 4 hours after.

As per the graphic below, Australians on the East Coast (AEDT) could trade between 8PM and 1:30AM (pre-market) or 8AM and 12PM (after hours) on top of the regular hours of between 1:30AM and 8AM.

I’ve been a Stake customer for a while and would have loved this feature in the past. I’ve stayed up before and those times where I didn’t, I selected market value which meant the purchase would occur automatically, but would be exposed to any price changes (up or down) during the pre-market that I could do nothing about.

By having access to the pre and post-market, you could trade on the large movements in stock prices based on breaking news that occurs outside the standard trading (just keep in mind the risks above).