Since 2017, Stake has accumulated 360,000 customers across Australia, New Zealand, the UK and Brazil by offering commission-free brokerage when investing in shares. To date, the service has only enabled trading of US-based stocks, and has today announced they are opening their doors to trades on the Australian Stock Exchange (ASX).

Like most modern platforms, Stake enables traders to invest in fractional shares.

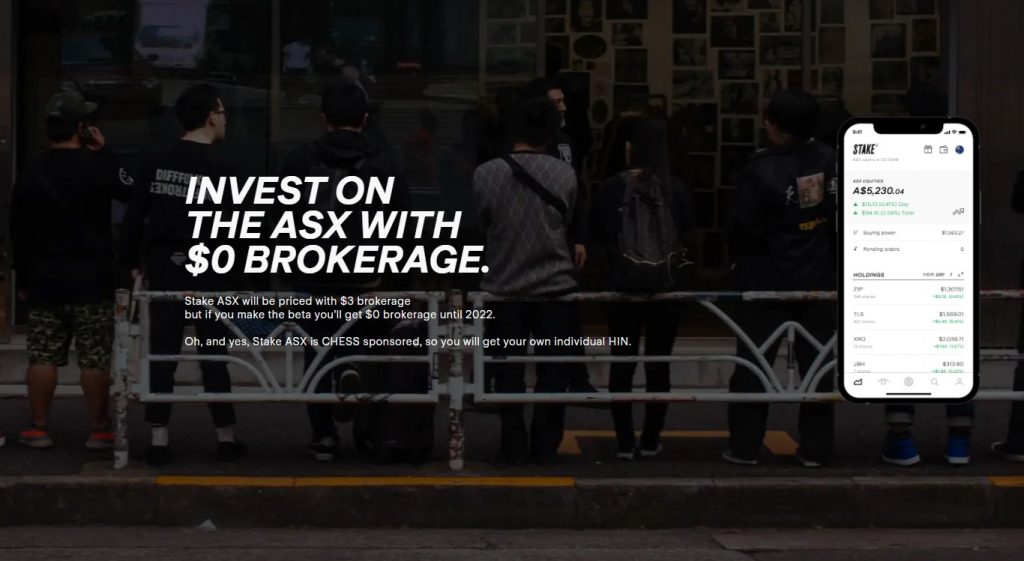

Typically when you trade shares, you head to the bank you’re currently with and use their trading platform. These are often incredibly fee heavy, while Stake has announced they will be doing it at $3 brokerage and with a CHESS-sponsored model.

CHESS stands for Clearing House Electronic Subregister System. If your shares are ‘CHESS Sponsored’ it means when you buy or sell shares the ASX has a record of you owning those shares directly. This gives you greater account control and security.

To put that into perspective, Commonwealth Bank’s Commsec will charge you $10 for up to $1,000 trades, $19.95 for up to $10,000 trades, $29.95 for trades up to $25,000 and if you invest more than $25,000, they take a percentage -0.12% of the transaction.

“Paying $30 per ASX trade via established banks has long been par for the course for Aussie investors but they’re not getting anything for that price tag – it can be done better, and for less.

Our customers now have a sleek platform where they can seamlessly access both Wall St and the ASX at the lowest brokerage fees out there, without compromise. This isn’t just low-cost trading, this is modern brokerage built for the new generation of investor.

This isn’t about cutting corners, this is about doing things the right way.”

Stake founder and CEO Matt Leibowitz.

This in addition to Stake’s mainstay $0 brokerage on more than 6000 US stocks and ETFs which can be traded on both its app and website. Stake ASX is live in Beta, offering people the chance to access it now.

Those who get early access via the Beta will also be rewarded with $0 brokerage on ASX trading until the end of the year.

“We’ve kicked off already. People are trading on the ASX with Stake. We’re opening up thousands more spots, progressively, over the next couple of months. People atop our Beta waitlist will be taken on, which thousands have already signed up to.

You jump ahead in the queue each time you refer a friend to the waitlist. Sign up, refer and climb, and you’ll be trading for free on the ASX until 2022.”

At $3 brokerage for ASX trades, Stake is the lowest cost CHESS-sponsored offering bar none. Leibowitz says while price is a crucial element, arguably more vital is building something that doesn’t sacrifice on comprehensiveness.

“We know how important the CHESS model is to Australian investors. They want to trade on their own HIN. We have found a way to make this work while still being able to deliver fantastic affordability.”

“This is brokerage done right. Putting customers first and giving investors a comprehensive offering at a fair price.”

“With ASX, investors are getting everything they need – access to more than 2000 companies and exchange-traded funds (ETFs), instant funding into an AUD wallet, and a dedicated dashboard for their Australian holdings.

“It’s giving people the tools to unlock unlimited opportunities for building their portfolio. They can do so with the knowledge that their cash, securities, and data are safe and protected.”

To Stake your claim to $0 brokerage until 2022, sign up to the ASX beta waitlist here: hellostake.com/asx. Beta intakes will begin from early October.