EV drivers across Victoria are rejoicing as the saga of the ZLEV (zero and low emission vehicle) road user charge has come to a conclusion. VicRoads has finally begun issuing refunds, complete with compounding interest.

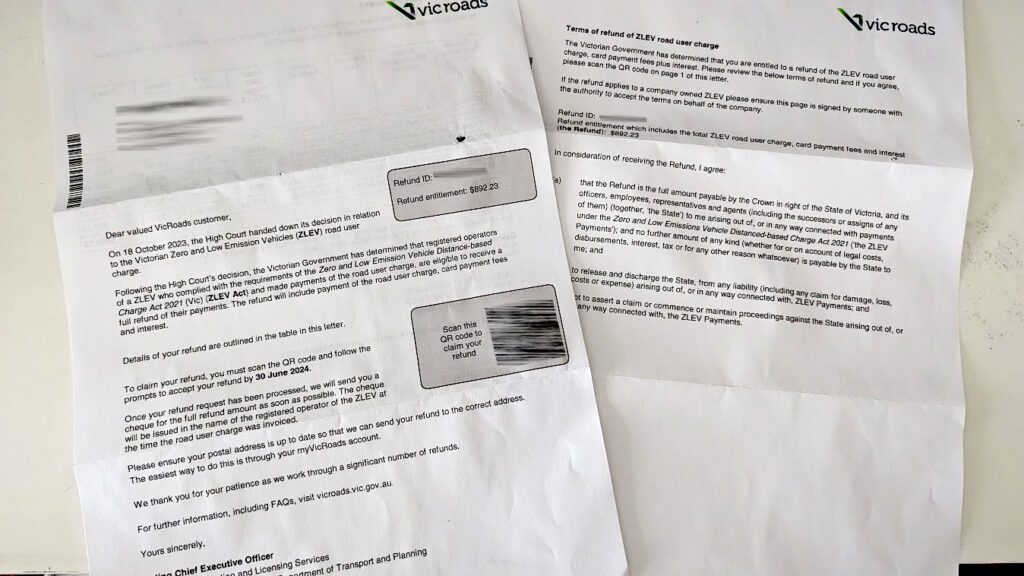

Since 2019, I’ve owned an EV and paid the EV Tax between 2021 and 2023. This week, I received a letter in the mail from VicRoads detailing that they were refunding me $892.23. The letter is signed by the Acting Chief Executive Officer of VicRoads Registration and Licensing Services, a delegate to the secretary to the Department of Transport and Planning.

The ZLEV provided a disincentive for potential EV owners to buy an EV, at a time when EV adoption was in its infancy. Victoria moved to create this EV tax ahead of the rest of Australia, something that was ultimately ruled to be illegal.

From July 1st, 2021, the new EV tax was charged as a road user charge, calculated based on the number of kilometres you drive between rego payments. When making your registration payment, you would provide a photo of your vehicle’s odometer and a new ZLEV invoice would be generated. The rates started at:

- 2.5 cents per kilometre for battery electric vehicles (BEVs)

- 2.0 cents per kilometre for plug-in hybrid electric vehicles (PHEVs)

The price was indexed to inflation, meaning it increased over time, rising each financial year. Credit to Chris Vanderstock for taking the issue to the High Court and winning in October 2023.

The last Zero and Low Emissions Vehicles (ZLEV) rates before it was cancelled on October 18, 2023, were:

- 2.8 cents per kilometre for battery electric vehicles (BEVs)

- 2.3 cents per kilometre for plug-in hybrid electric vehicles (PHEVs)

There’s a lot of detail on the EVTax refund now available on the VicRoads website, and contained in the letters sent to Victorian EV owners. Included in the refund, was a table of payments made for the Road User Charge, along with card payment fees and interest paid.

The interest was calculated using compounding interest, paid annually at the end of each financial years at a rate that is based on CPI for Victoria during 1/7/2021 and 1/2/2024. These ranged between 4.0% and 6.9%.

Personally, I paid $822.00 in EV tax and was paid $65.80 in interest, for a total of $892.23. Interestingly the VicRoads website has severe restrictions on its transaction history. You can only search a 3-month window and you can’t search back further than 15 months ago.

To claim the refund, EV owners are required to scan a QR code on the letter, follow the prompts and accept the refund by June 30th 2024. The refund will occur by Cheque, sent to your registration address for the vehicle.

Last year, I submitted a freedom of information request and was able to reveal that Victoria’s EV Tax raised $5 Million dollars.

The refunds being processed now, including interest, are likely to be around $5.2 Million. Given there will be some EV owners that don’t apply before the deadline, or bank the cheque, the final cost to the Government will be the $5 Million raised (which we understand is spent), and the additional $5+ Million for the refunds.

Let us know if the comments if you’ve been impacted by the EVTax.

More information at VicRoads.